Hassle-free Medicare Supplements: Medicare Supplement Plans Near Me

Hassle-free Medicare Supplements: Medicare Supplement Plans Near Me

Blog Article

Discover the very best Medicare Supplement Program for Your Insurance Policy Demands

In the world of healthcare insurance coverage, the quest for the perfect Medicare supplement plan tailored to one's particular demands can typically look like browsing a maze of options and factors to consider (Medicare Supplement plans near me). With the complexity of the health care system and the array of available plans, it is essential to come close to the decision-making process with an extensive understanding and critical state of mind. As people begin on this trip to safeguard the most effective insurance coverage for their insurance needs, there are key factors to contemplate, contrasts to be made, and specialist tips to discover - all vital aspects in the pursuit for the optimal Medicare supplement strategy

Recognizing Medicare Supplement Program

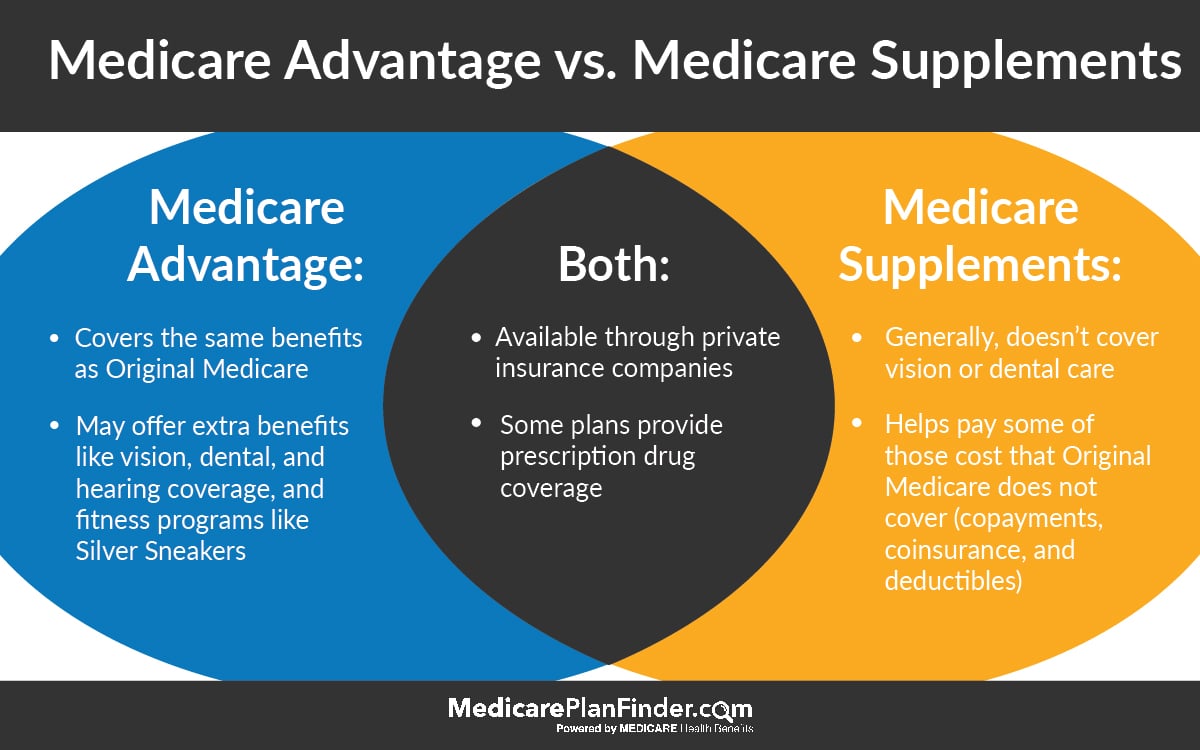

Comprehending Medicare Supplement Program is necessary for people seeking extra coverage beyond what initial Medicare offers. These strategies, additionally called Medigap policies, are offered by exclusive insurer to assist pay for health care expenses that initial Medicare does not cover, such as copayments, coinsurance, and deductibles. It's crucial to keep in mind that Medicare Supplement Plans can only be purchased if you already have Medicare Part A and Component B.

One trick aspect of comprehending these plans is understanding that there are different standard Medigap policies offered in the majority of states, classified A via N, each providing a different collection of fundamental benefits. For example, Strategy F is one of the most detailed plans, covering practically all out-of-pocket costs that Medicare doesn't pay. On the various other hand, Strategy A supplies less advantages however may include a lower costs.

To make an informed decision concerning which Medicare Supplement Strategy is best for you, it's vital to consider your health care requires, budget, and protection preferences. Consulting with a qualified insurance coverage representative or checking out on-line resources can help you browse the intricacies of Medicare Supplement Plans and select the very best alternative for your private circumstances.

Factors to Think About When Selecting

Having a clear understanding of your health care requirements and monetary abilities is paramount when considering which Medicare Supplement Strategy to select. Examine your existing health and wellness condition and anticipate any future medical demands. Think about elements such as prescription medication protection, medical professional gos to, and any type of potential surgical procedures or therapies. Next, evaluate your budget to determine exactly how much you can comfortably manage to pay in costs, deductibles, and other out-of-pocket costs. It's essential to strike an equilibrium between extensive insurance coverage and affordability.

One more vital element to consider is the strategy's coverage alternatives. Various Medicare Supplement Program deal varying levels of coverage, so make certain the strategy you choose straightens with your specific medical care demands. In addition, consider the reputation and monetary security of the insurance coverage firm providing the strategy. You want to choose a provider that has a solid record of client complete satisfaction and prompt cases processing.

Comparing Various Plan Options

When reviewing Medicare Supplement Program, it is vital to contrast the different plan choices readily available to establish the most effective suitable for your medical care requirements and financial situation. To start, it is important to recognize that Medicare Supplement click this site Strategies are standard across the majority of states, with each strategy classified by a letter (A-N) and using different degrees of insurance coverage. By contrasting these plans, individuals can assess the coverage provided by each plan and select the one that finest meets their details requirements.

When comparing various strategy choices, it is essential to take into consideration aspects such as regular monthly premiums, out-of-pocket prices, coverage benefits, supplier networks, and customer contentment ratings. Some plans might offer more comprehensive protection but come with greater monthly premiums, while others may have lower costs however less advantages. By assessing these facets and considering them against your health care demands and budget, you can make an educated decision on which Medicare Supplement Strategy offers one of the most worth for your individual conditions.

Tips for Finding the Right Insurance Coverage

Following, research study the offered Medicare Supplement Strategies in your location. Comprehend the coverage given by each strategy, including deductibles, copayments, and coinsurance. Compare the benefits used by different strategies to determine which lines up ideal with your health care concerns.

Consult from insurance agents look here or brokers focusing on Medicare strategies - Medicare Supplement plans near me. These experts can offer beneficial insights into the nuances of each strategy and aid you in picking the most proper coverage based upon your private scenarios

Last but not least, testimonial customer comments and scores for Medicare Supplement Program to gauge overall contentment degrees and recognize any repeating concerns or worries. Utilizing these suggestions will assist you browse the complex landscape of Medicare Supplement Program and discover the protection that finest matches your needs.

Exactly How to Sign up in a Medicare Supplement Strategy

Registering in a Medicare Supplement Plan entails a simple procedure that needs careful factor to consider and paperwork. The initial action is to ensure qualification by being signed up in Medicare Component A and Component B. As soon as eligibility is confirmed, the following action is to research and contrast the offered Medicare Supplement Program to find the one that ideal fits your medical care demands and spending plan.

To register in a Medicare Supplement Plan, you can do so throughout the Medigap Open Registration Duration, which begins the initial month you're 65 or older and enlisted in Medicare Part B. During this period, you have guaranteed concern legal rights, indicating that insurance coverage business can not deny you protection or charge you greater costs based upon pre-existing conditions.

To sign up, simply get in touch with the insurer using the wanted plan and complete the required documentation. It's necessary to examine all terms before subscribing to ensure you understand the protection given. When enrolled, you can take pleasure in the added benefits and tranquility of mind that include having a Medicare Supplement Plan.

Conclusion

To conclude, selecting the ideal Medicare supplement strategy requires mindful factor to consider of factors such as protection alternatives, costs, and copyright networks. By comparing various strategy options and examining private insurance coverage requirements, people can find one of the most ideal insurance coverage for their medical care demands. It is crucial to sign up in a Medicare supplement plan that uses thorough benefits and economic security to ensure comfort in taking care of medical care expenditures.

Report this page